Our Product

All 50 U.S. States, 200+ Countries

TaxDay can accurately track travel in all 50 U.S. States, including Puerto Rico and the U.S. Virgin

Islands. It also accurately tracks travel in over 250 countries and provinces globally.

TaxDay iOS version will also separately track travel in the five NYC boroughs of Manhattan, Queens,

Brooklyn, the Bronx and Staten Island apart from New York State. In addition to NY City tracking,

TaxDay Android version will also track major cities in Pennsylvania (Philadelphia, Pittsburgh,

Harrisburg, Allentown), Ohio (Cleveland, Cincinnati, Columbus, Toledo), and Michigan (Detroit, Ann

Arbor, Grand Rapids).

When traveling outside the U.S., TaxDay will generate a new Travel Record for that

country/jurisdiction to record the entire duration of your time there until a new jurisdiction has been

detected. The sum of all travel outside the U.S. will be included and shown in a “Non-U.S. Travel”

record on the TaxDay home screen.

Click the button below to see a list of all countries where detailed tracking is available.

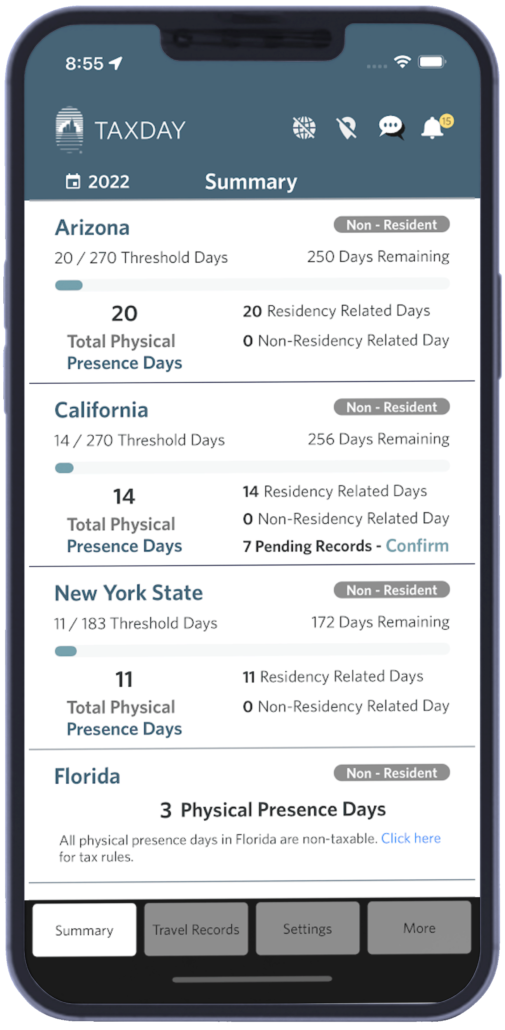

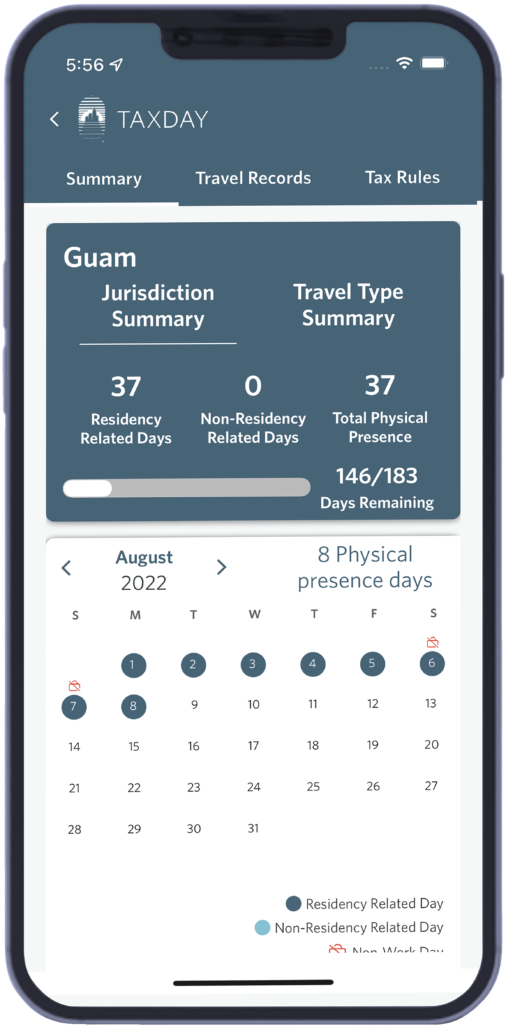

Friendly Quick Views and Alerts

Monitor your travel to multiple tax jurisdictions daily using the calendar summary showing travel days in each city and state.

You can also set buffers and notifications to alert you when you’re approaching a residency threshold that could trigger a change in your tax filing.

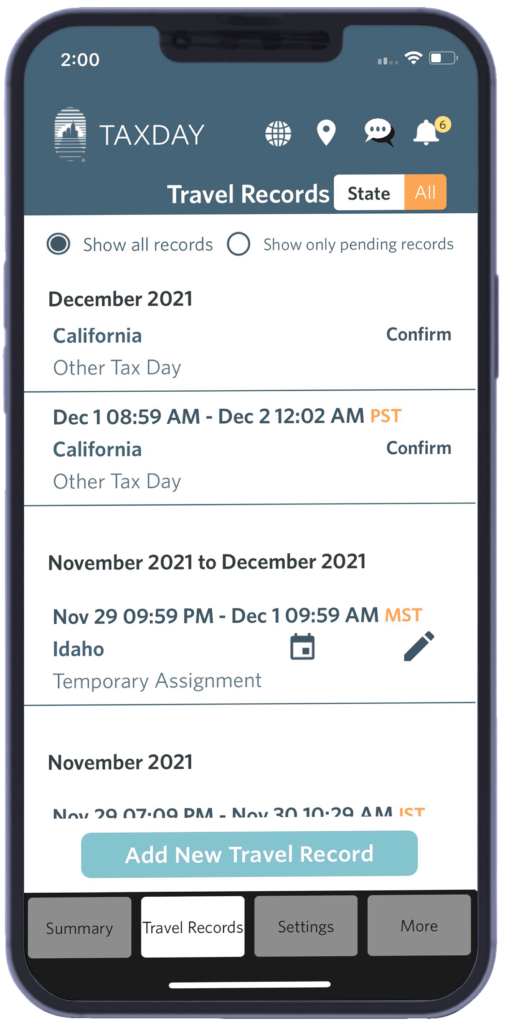

Comprehensive Travel Logs

Easily review and verify each travel day logged in a jurisdiction, add additional notations or make adjustments based on your day to day life. Accurate travel records, down to the day, at your fingertips.

Security and Privacy

TaxDay uses your mobile device’s GPS to track time you spend in a specific city or state, not the specific locations you visit while there. You can rest assured your data is private and safe.

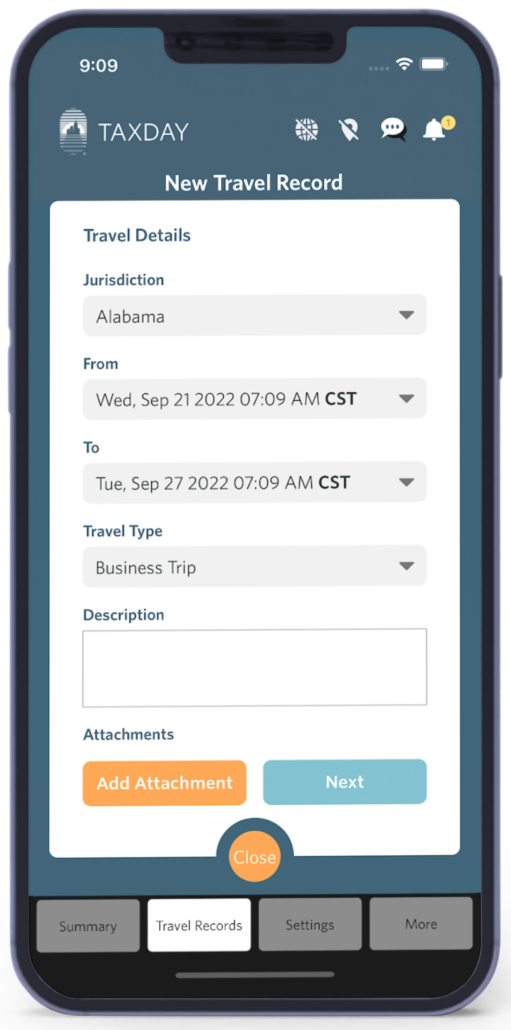

Easy Data Uploading

Two homes in two different states? We’ve got you covered. Attach digital flight itineraries and receipts to travel records as additional proof of your location.

Work-day vs. Non-work Day Tracking

TaxDay allows you to track your travel records by work and non-work days for ease of allocating income across multiple jurisdictions. For accurate travel details, you can further segment your non-work days travel into Weekends, Holidays, and Vacations.

Calender view with details on travel types

TaxDay now records “physical presence days,” which tracks the number of days you are present in a jurisdiction, without regard to the travel type (non-tax days, vacation, holiday or weekend days).

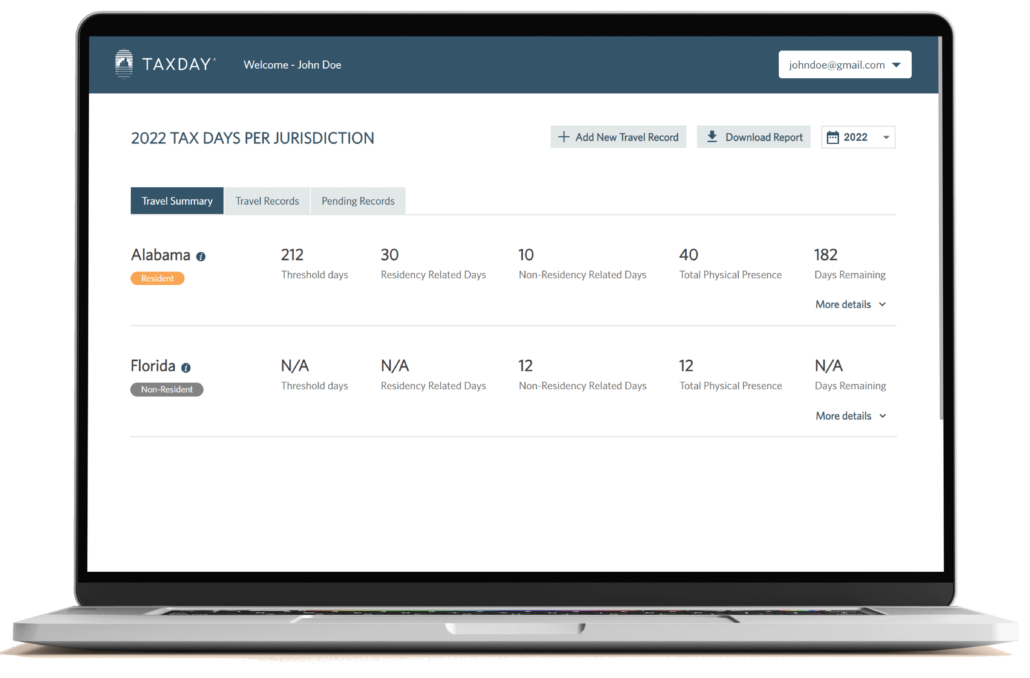

Web Portal Access

TaxDay now has a web portal that allows you to save multiple Pending Records, add or modify existing travel records, and generate a variety of travel reports.